EXTERNAL BENCHMARK LENDING RATE Vs MARGINAL COST OF FUNDS BASED LENDING RATE

- excelsiorfinserv

- Sep 1, 2022

- 2 min read

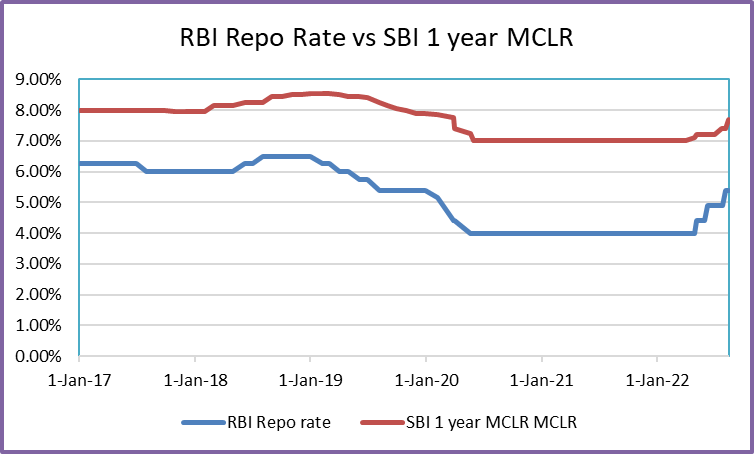

We often hear about various benchmarks over which banks mark up their interest rates spreads for borrowers. At present the primary benchmarks used are Marginal Cost of funds-based Lending Rate (MCLR), RBI Repo rate, 91 Day and 180 Day T-Bill Rates published by FBIL. The MCLR rate was introduced by RBI, in 2016, to replace the Base rate. MCLR is a cost-based lending rate, every bank would have to compute its own MCLR based on costs such as the marginal cost of funds based on its deposit rate and other borrowings; the loss of carry due to its mandatory deposits with RBI such as Cash Reserve Ratio (CRR); its operating costs and tenor premium. Repo rate is a key indicator of interest rates in the macro environment. RBI had been consistently reducing the Repo rate, the rate at which Banks borrow from RBI, since 2013. The MCLR rates were not keeping pace commensurately. Hence RBI introduced the external benchmark rates against which Banks were to benchmark the interest rates, especially their retail and SME loans so that SMEs and retail borrowers could reap the benefit of these lower interest rates. These external benchmarks were the RBI Repo rate and the 91 D and 180 D Treasury bills issued by RBI on behalf of the GOI. Repo rates fell from 6.25% in early 2017 to 4% in 2020 and remained at 4% during almost the entire 2 years of the pandemic. During the same period 91D T-Bill have moved in a wide range of above 7% to even below 3% while the MCLR of State Bank of India fell from 8% to 7%.

Since MCLRs have not kept pace with the fall in interest rates, the spread between Repo rate and SBI MCLR widened from a low of approximately 175bps to about 3% during the 2017-2022 period. Hence borrowers have benefited by having their borrowings linked to the external benchmarks. But this could also go against the interest of borrowers when the cycle is on the upturn as in the current situation. MCLRs tend to be sticky as compared to market linked benchmarks like Treasury bills and even RBI Repo rate to a large extent. In this rising interest rate scenario, the sharp rise in borrowing rates could take the borrowers by surprise. Although MCLR rates could eventually catch up, we would assume that the gradient is likely to not be as steep. Remains to be seen what is the stance of policymakers with respect to this new scenario.

Comments